In App Advertising revenue has surpassed In App Purchase Revenue, implementing an IAP (In App Purchases) functionality to an app is rather simple with Apple and Google being the only IAP SDK’s allowed on iTunes and Google Play respectively, choosing between in app advertising SDK options is very complicated.

There is a variety of over 400 advertising SDK’s, each guarantees great results – making it difficult to choose from, since each SDK performs differently, and results vary drastically.

A/B testing Between the in app advertising solutions can be quite expensive, testing a solution requires development costs in addition to possible losses due to poor performance CPM wise.

When choosing a service provider there is a big advantage when choosing a solution that has been tested at scale, that has been selected from the mass and used by top publishers, which rely on in app advertising revenue, know the solutions and have already conducted their tests.

There Are Twice As many Apps Monetizing with in app advertising:

Looking at our data, we have discovered that 289,671 apps on Android use In App Purchases while 601,205 apps use in app ads in order to generate revenue, while on iOS we see 135,692 apps that monetize using In App Purchases and 320,000 apps that use ads. Interestingly, the top app publishers who monetize with ads do not settle on one advertising SDK, but rather choose to utilize multiple ad SDKs in their apps in order to maximise revenues.

Let’s take a look at some of the biggest publishers on the market and how they monetize.

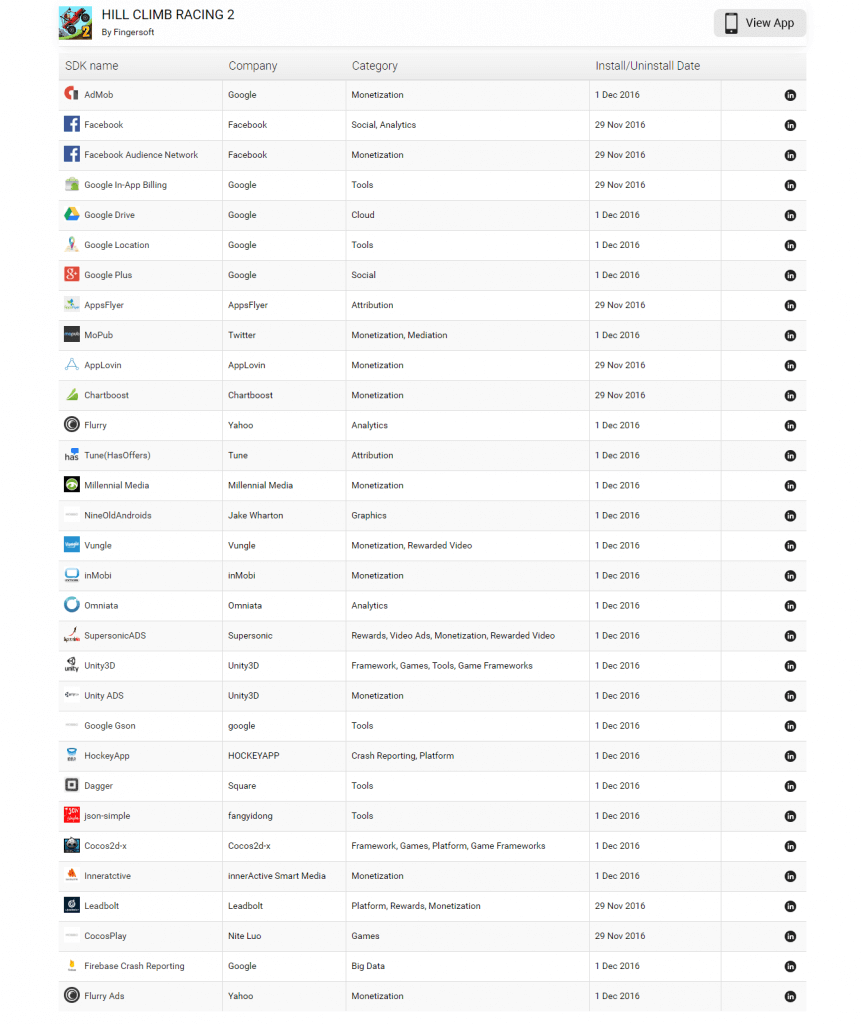

Hill Climb Racing 2

We can see that they are using 12 different advertising SDKs in their app: AdMob, Facebook Audience Network, MoPub, AppLovin, Chartboost, Millennial Media, Vungle, inMobi, SupersonicADS, Unity ADS, Inneratctive, Leadbolt and Flurry Ads.

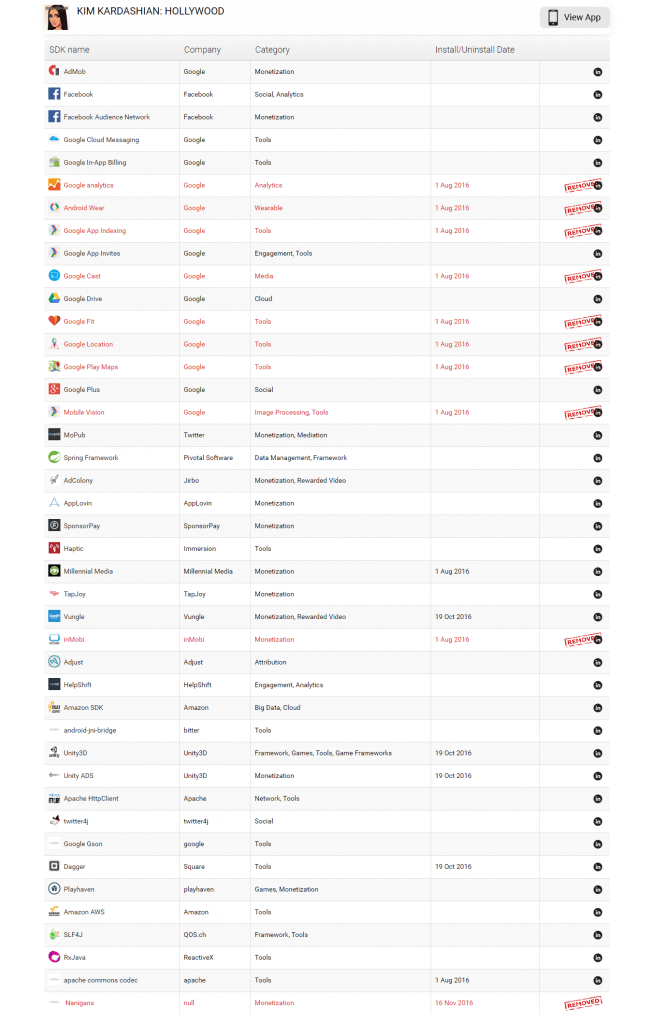

Kim Kardashian: Hollywood is one of the biggest hits with over 50 million downloads, lets see what technologies they decided to implement.

We can see that Glu decided to go with AdMob, Facebook Audience Network, MoPub, AdColony, AppLovin, SponsorPay, Millennial Media, TapJoy, Vungle, Unity ADS and Playhaven and they removed inMobi and Nanigans from their app.

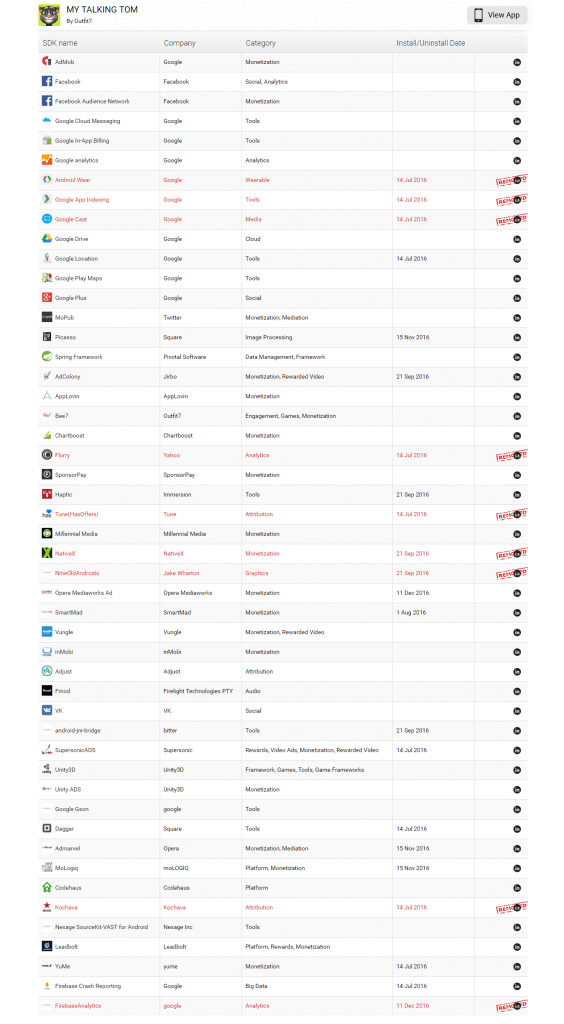

Talking Tom is one of the most famous and popular apps on Android – it is also one of the oldest.

As we can see here Talking Tom has whooping 19 monetization SDKs: AdMob, Facebook Audience Network, MoPub, AdColony, AppLovin, Bee7, Chartboost, SponsorPay, Millennial Media, Opera Mediaworks Ad, SmartMad, Vungle, inMobi, SupersonicADS, Unity ADS, Admarvel, MoLogiq and Leadbolt.

Outfit7 removed only one monetization SDK: Leadbolt.

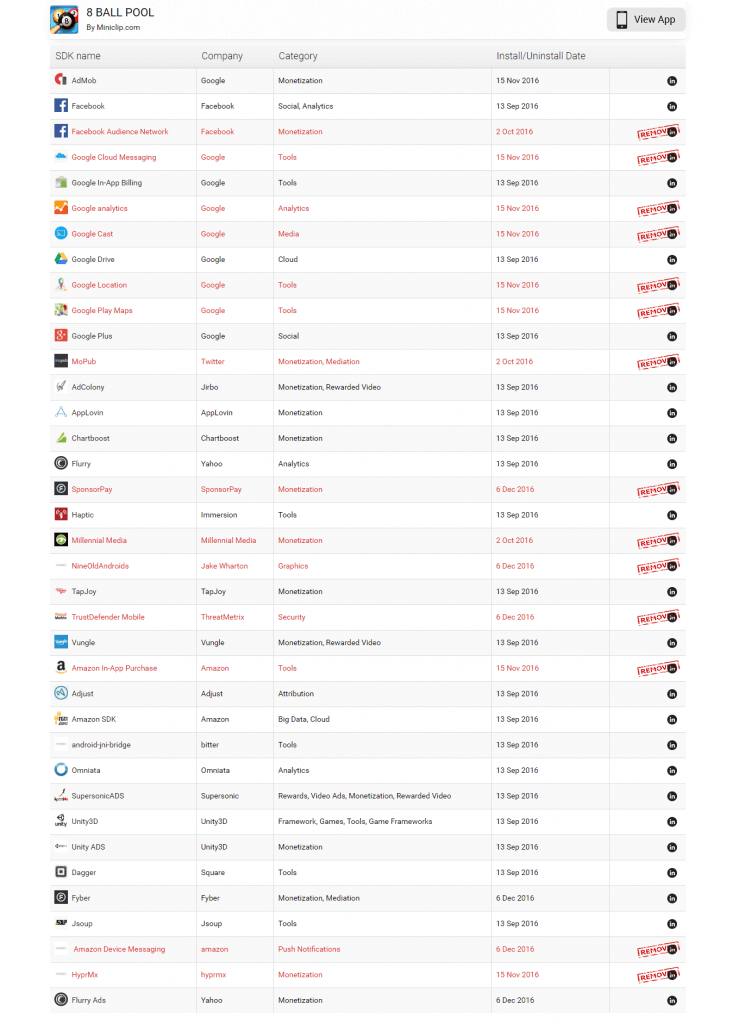

The last app we are taking a look at is 8 Ball Pool published by Miniclip, it has over 100 million downloads and is currently the second most popular free game in the US.

As we can see Miniclip are constantly improving and optimizing 8 Ball Pool and they are implementing 10 monetization SDKs in this app: AdMob, AdColony, AppLovin, Chartboost, TapJoy, Vungle, SupersonicADS, Unity ADS, Fyber and Flurry Ads.

On the removal side we can see that they removed Facebook Audience Network which is a very popular monetization option. They also removed MoPub, SponsorPay, Millennial Media and HyprMx.

Note that S2S and API integrations are not documented in our study, and that some of the apps surely utilize sdkless integrations as well, so the average number of advertising solutions integrated in top publishers apps is even bigger.